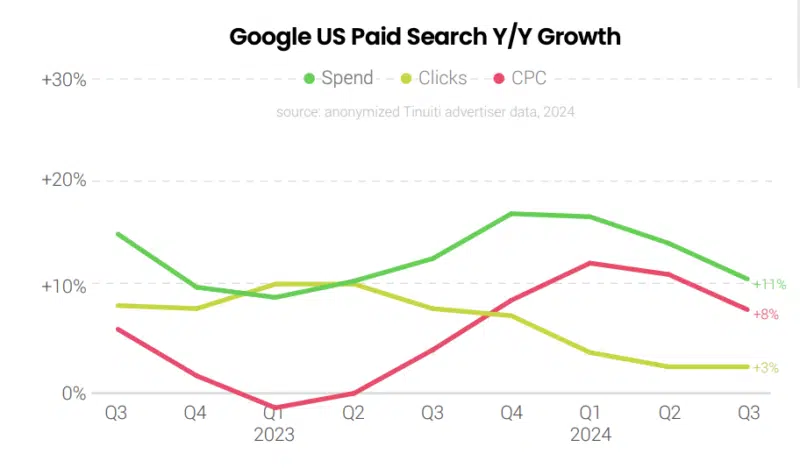

Google search ad spending increased by 9% year on year in Q1 2025, according to new statistics from digital marketing agency Tinuiti. Increasing prices, rather than click volume, drove the majority of the growth.

Google Search Overall:

Google Search spending increased by 9% YoY in Q1 2025 (a little decrease from 10% in Q4 2024).

Click increase remained consistent at 4% YoY.

While the average cost per click (CPC) grew by 5% YoY.

Screenshot 2025-04-22 at 14.29.24: Google Shopping Ads.

Shopping ads saw 8% YoY spending growth (down from 10% in Q4 2024).

Click volume increased by 9% YoY (from 1% in Q4).

CPC remained constant, with a 1% YoY drop.

Screenshot: 2025 04 22 at 14.34.04

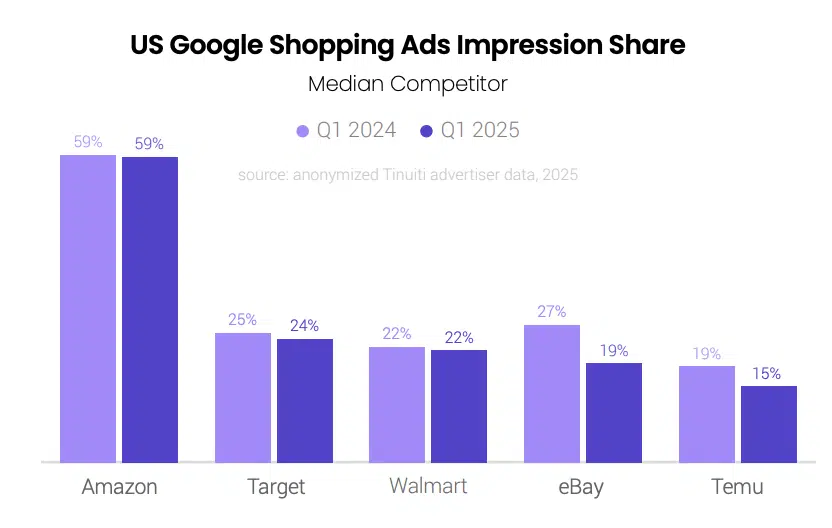

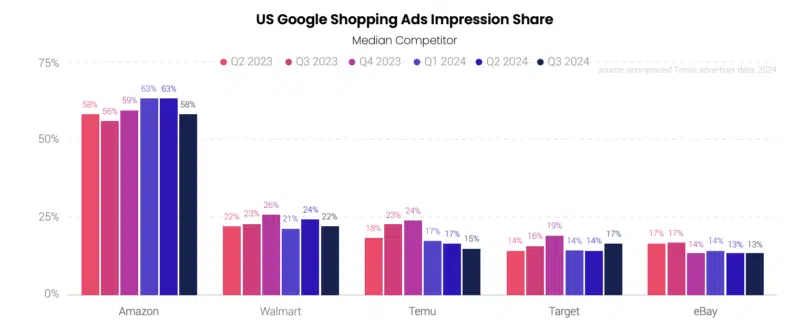

Competitive landscape.

Amazon maintained a significant presence in Google shopping auctions, with around 60% impression share against the median retailer, comparable to Q1 2024 levels.

READ MORE: Google Loses The Adtech Monopoly Case

The target remained at 24% impression share (down slightly from 25% in Q1 2024).

Walmart retained 22% impression share year after year.

Temu rapidly dropped its Google shopping presence in early April in response to news of tariff adjustments in the United States, reaching 0% impression share by mid-April.

Screenshot 2025-04-22 At 14.42.27 Maximum Performance:

93% adoption rate among retailers implementing Google Shopping advertisements.

accounts for 53% of Google Shopping ad spending (down from 69% in Q4 2024).

Has a 10% lower conversion rate than normal Shopping.

Has 13% more CPC than normal Shopping and 7% lower ROAS. Shopping

Screenshot 2025-04-22 at 14.47.12: Microsoft Search.

READ MORE: Roblox And Google Collaborate On Advertisements

YoY spending growth is 17% (up from 7% in Q4 2024).

5% YoY click growth (up from 3% fall in Q4)

11% YoY increase in CPC

Brand keywords experienced particularly dramatic CPC increases, with text advertisements including an advertiser’s own brand name climbing 19% against only 3% for non-brand terms.

Why we care. The latest statistics demonstrate that search engines continue to collect more income per click, placing pressure on advertisers’ margins even as rivalry between Google and Microsoft heats up. Microsoft’s growth rate (+17% YoY) is higher than Google’s (+9% YoY), indicating that Microsoft remains a strong challenger in marketing strategy.

Political concerns have also had a significant impact, with Temu opting out of shopping ads, indicating that there will be additional adjustments in shopping traffic and expenses in the second quarter of 2025.

What we’re looking at: Performance Max adoption remained high at 93% of shops running Google shopping ads, but its percentage of expenditure dropped from 69% in Q4 2024 to 53% in Q1 2025 as some advertisers transferred funding back to conventional shopping campaigns for greater control.

Step into the ultimate entertainment experience with Radiant TV! Movies, TV series, exclusive interviews, live events, music, and more—stream anytime, anywhere. Download now on various devices including iPhone, Android, smart TVs, Apple TV, Fire Stick, and more!